Stephen Bogan, a prestige car dealer, could be forgiven for the confusion. While checking on a loan being used to buy a £41,000 Porsche from his showroom in Airdrie, Scotland, Mr Bogan was alarmed to discover that his company was listed as the buyer. The attempted fraud was barely more sophisticated than skimming his details from the internet and asking for a loan, he says, adding that “the bank still paid out the money”.

“It was the perfect crime because we would not have been aware until next year when the bank would have started asking us for interest on the loan,” says the car seller.

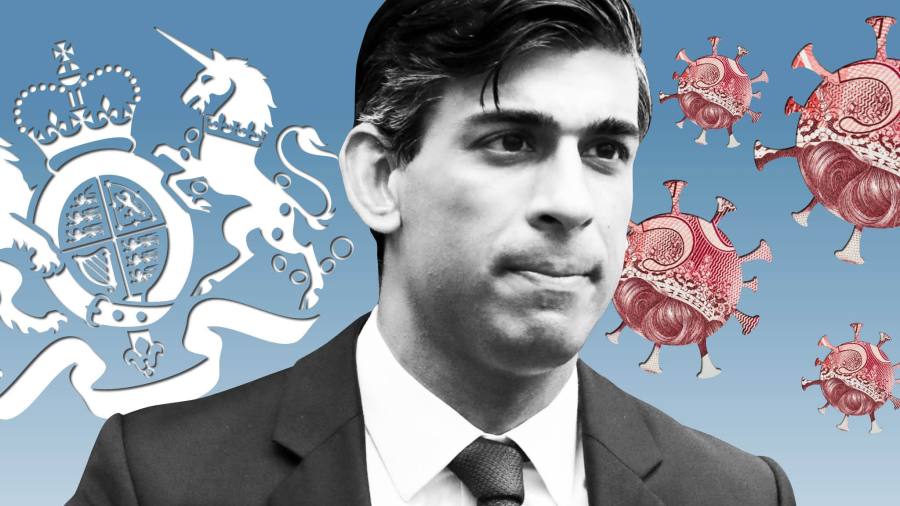

Mr Bogan was the target of fraudsters seeking to exploit weaknesses in the UK government’s £43.5bn coronavirus Bounce Back Loans Scheme. Launched by chancellor Rishi Sunak in May, it was designed to provide cash quickly for struggling businesses, but its loose rules were immediately exposed with some estimates suggesting as much as £26bn will be lost to defaults and fraud.

The…