Buy now. Pay later. What’s not to like? Particularly when incomes may have taken a hit, credit card limits may have been cut and traditional lenders may not be giving out personal loans as easily as they once did.

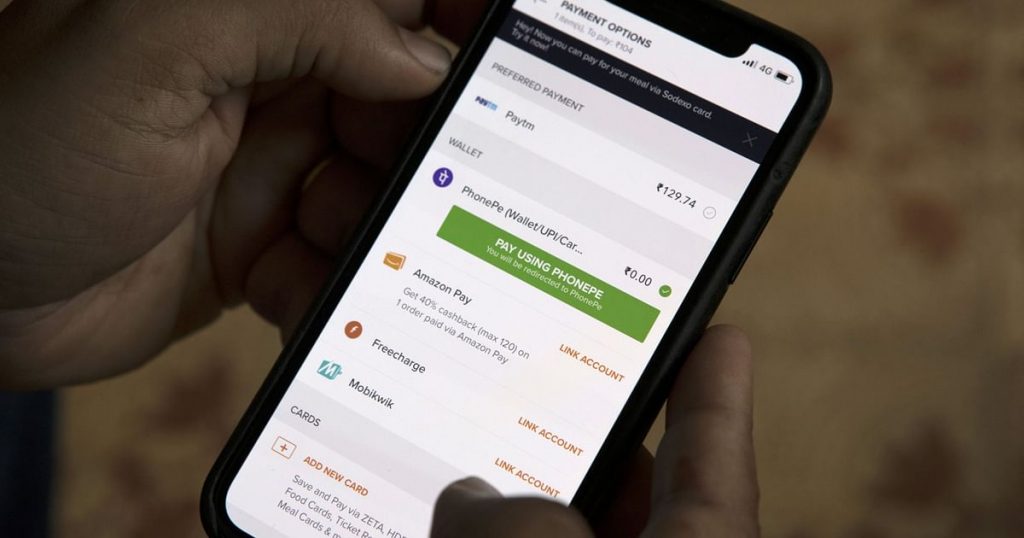

As legacy lenders turn risk-averse amid a weak economy, a segment of digital lenders is powering ahead luring consumers with the promise of ‘buy now, pay later’, or BNPL as it has come to be known.

While no formal industry-wide data exists on this segment of credit, conversations with those who offer and process such credit suggest the trend is gaining traction.

Pine Labs is a company that processes ‘buy now, pay later’ payments from a host of lenders. Its payment terminals reported Rs 1,700 crore worth of sales through pay later options, just in the month of October. Total spends on Pine Labs’ terminals stood at Rs 12,900 crore during this period. In the…