BQ Prime’s special research section collates quality and in-depth equity and economy research reports from across India’s top brokerages, asset managers and research agencies. These reports offer BQ Prime’s subscribers an opportunity to expand their understanding of companies, sectors and the economy.

Investment Thesis:

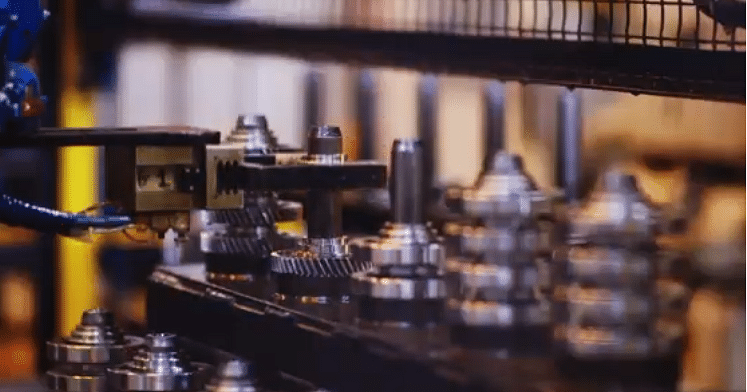

Sensing organic growth opportunities in India as well as export potential that it holds CIE Automotive India Ltd. has strategically aligned its goals wherein it intends to incur growth capex in India while at the same time focus upon improving operational efficiencies at its European operations.

Indian operations are currently recording ~17% Ebitda margins while its European operations post discontinuance of its German forging business and normalisation of power costs have started to clock ~18% Ebitda margin profile.

For its European operations on the back of limited scope of organic growth amidst developed nature of these economies and faster transition towards electrification CIE Automotive’s aim is to consolidate its position in ICE space, win new orders in the electric vehicle domain and further work upon operational efficiencies.

At its Indian operations, given the developing nature of domestic economy amidst underpenetrated passenger vehicle category and cyclical upswing in commercial vehicle space, steady demand in two-wheeler and tractor space and growing thrust on exports amidst China plus one trend, CIE is well poised for double digit revenue growth and further improvement in margins amid operating leverage gains.

-

Strong margins, return ratios, cash flow from operation yield merit PE re-rating for CIE Automotive:

On the consolidated basis, topline/Ebitda at CIE is expected to grow at a compound annual growth rate of 11%, 21.3% over CY22-24E. Ebitda margins are seen improving from 13.4% levels in CY22 to 16% in CY24E. Return on capital employed in the similar timeframe is seen improving from 13.4% to 18.4%. Cash flow generation has been the key USP and differentiating factor at CIE with Ebitda to cash flow from operation generation at healthy 75% plus with present cash flow from operation yield pegged at attractive ~7% thereby making PE re-rating imminent for CIE automotive.

CIE also has lean balance sheet with debt/equity at 0.2 times as of CY22 with net debt less than Rs 300 crore and is expected to turn net cash positive in CY23E amid broader intent to spend ~5% of sales as capex.

Click on the attachment to read the full report:

DISCLAIMER

This report is authored by an external party. BQ Prime does not vouch for the accuracy of its contents nor is responsible for them in any way. The contents of this section do not constitute investment advice. For that you must always consult an expert based on your individual needs. The views expressed in the report are that of the author entity and do not represent the views of BQ Prime.

Users have no license to copy, modify, or distribute the content without permission of the Original Owner.