Introduction to Commodity Channel Index

The Commodity Channel Index ( CCI) was developed by Donald Lambert. Initially, the Commodity Channel Index was created as an indicator for determining the turning points on commodity markets, but over time it became popular in the stock market and in the Forex market. The assumption on which the indicator is based is that all assets move under the influence of certain cycles, and the maxima and minima appear with a certain interval.

CCI refers to the type of oscillators that measure the speed of the price movement.

Formula of the Commodity Channel Index indicator:

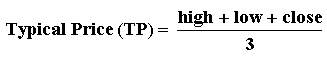

First, a typical price (Typical Price) is calculated:

A simple moving average is calculated from the characteristic price:

The probable (median) deviation is calculated.

The formula for the CCI indicator itself will look like this:

For scaling purposes, Lambreth set the constant at 0.015 so that approximately 70 to 80% of the Commodity Channel Index values were between -100…