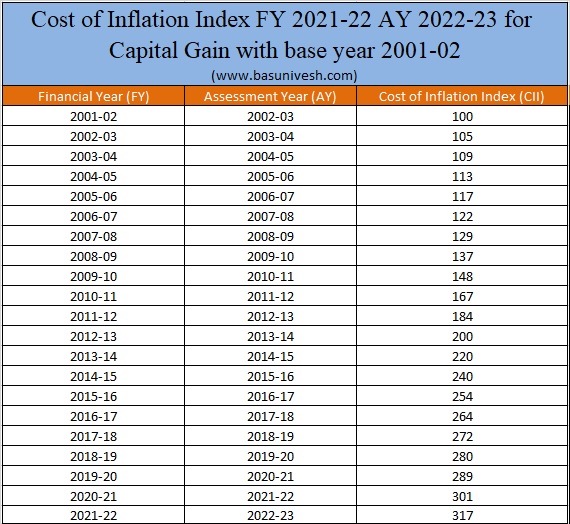

CBDT notified the Cost of Inflation Index FY 2021-22 AY 2022-23 for Capital Gain on 15th June 2021. You may be aware that the base year was changed from the earlier FY 1981-82 to FY 2001-02.

Change in the Base year for Capital Gain Indexation

In Budget 2017, the Government proposed to change the base year to calculate the indexation benefit from 1981 to 2001. Do remember that the change in the base year is across all asset classes but the impact would differ across assets that enjoy indexation benefit on long-term capital gains—real estate, unlisted shares, gold, and bond funds. Up to 31st March 2017, the capital gain was calculated with 1981 as the base year. This means that the purchase price of an asset bought before 1 April 1981 could be calculated on the basis of the fair market value of 1981. However, from 1st Apr 2017, the purchase price will be calculated based on the fair market value of 2001. Accordingly, capital gains on assets acquired before 1 April…