(Bloomberg) — The US inflation rate slipped to a more than two-year low, spelling relief for American consumers and moving the Federal Reserve a step closer toward ending an historic cycle of interest-rate hikes.

China’s economy continues to struggle, with recent trade figures showing the largest drop in exports since early 2020. Industrial output in Europe remains weak, while strong wage growth in the UK threatens to add to inflationary pressures.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

US inflation cooled sharply last month, offering fresh hope that the Fed can wrap up the most aggressive tightening in decades soon after an expected hike at their July 25-26 meeting.

The Bank of Canada raised interest rates for a second straight meeting, keeping the door open for more hikes as it pushed back inflation’s return to its 2% target. At 5%, the overnight lending rate is the highest in 22 years.

Some 72,700 people in families with children were experiencing homelessness in 20 of the largest cities in the US as of January, a 37.6% jump from a year before, according to an analysis of data provided by jurisdictions. In New York, that figure shot up by two thirds, while Chicago, the District of Columbia and Fort Worth, Texas, also saw outsize increases.

China is facing pressure on trade as foreign shipments drop off and domestic demand remains weak, with a darkening global growth outlook and geopolitical tensions making a reprieve unlikely anytime soon.

India, the world’s biggest rice shipper, is considering banning exports of most varieties, a move that may send already lofty global prices higher as the disruptive El Niño weather pattern returns.

Australia’s business conditions showed ongoing resilience in June, defying the Reserve Bank’s more than yearlong tightening cycle and warnings of slower economic growth, while consumer confidence remained in “deeply pessimistic” territory.

UK wages rose more than expected to a level that Bank of England Governor Andrew Bailey said is fueling inflation, maintaining pressure for higher interest rates. Average weekly earnings excluding bonuses rose 7.3% in the three months through May from a year ago.

Euro-area industrial production rose less than anticipated in May — adding to signs that manufacturing is struggling to regain momentum after the 20-nation bloc suffered a recession over the winter.

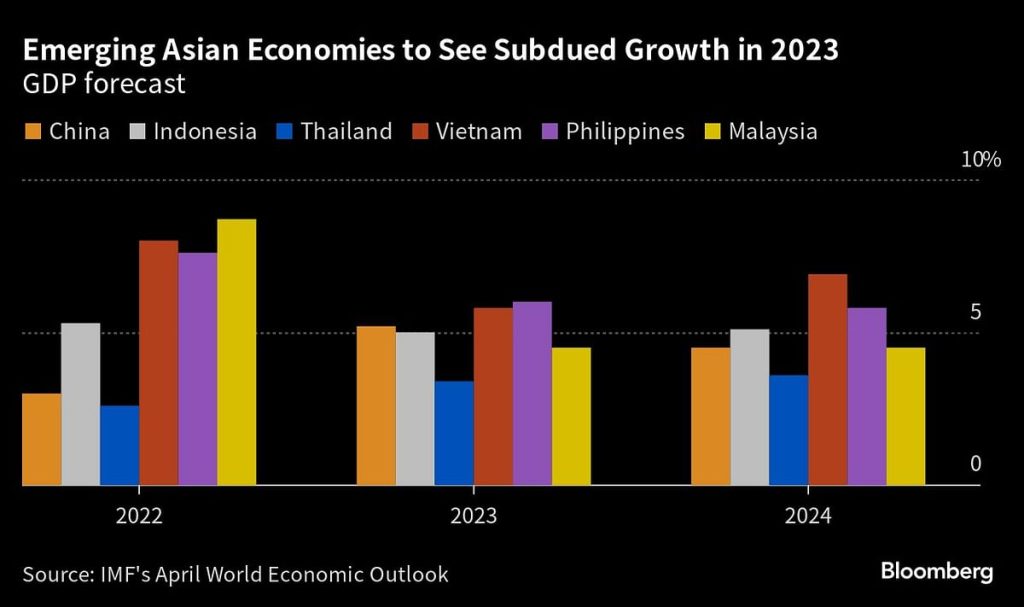

Southeast Asian nations that were counting on Chinese travelers to drive tourism revenues and their economies post-Covid are finding the flow of visitors far from the flood they were hoping for. The visitor statistics suggest that Southeast Asia’s economic recovery this year will be muted.

Saudi Arabia’s decision to extend its oil production cuts — part of a largely unsuccessful bid to raise prices — may trigger an economic contraction in what was the Group of 20’s fastest-growing country last year.

Brazil’s inflation fell below target in June to hit its slowest level since September 2020, clearing the way for the central bank to begin cutting interest rates at its next meeting.

Israel left interest rates unchanged for the first time in over a year while New Zealand’s central bank stood pat for the first time since August 2021. Peru kept borrowing costs at a 22-year high and South Korea held rates steady.

–With assistance from Philip Aldrick, Erik Hertzberg, James Mayger, Abeer Abu Omar, Aline Oyamada, Swati Pandey, Pratik Parija, Tom Rees, Andrew Rosati, Augusta Saraiva, Zoe Schneeweiss, Siddhartha Singh, Randy Thanthong-Knight, Fran Wang, Lucy White, Sonja Wind and Yihui Xie.