Sales and interest coverage ratio across manufacturing companies improved in the quarter ended December, even though non-IT services firms continued to feel the pressure of the Covid-19 crisis.

The quarter also saw staff costs for manufacturing and IT services firms rise. Non-IT services, part of which are high contact services, however, saw a slower pace of normalisation.

The findings are based on the Reserve Bank of India’s compilation of financials for 2,692 listed non-government non-financial companies.

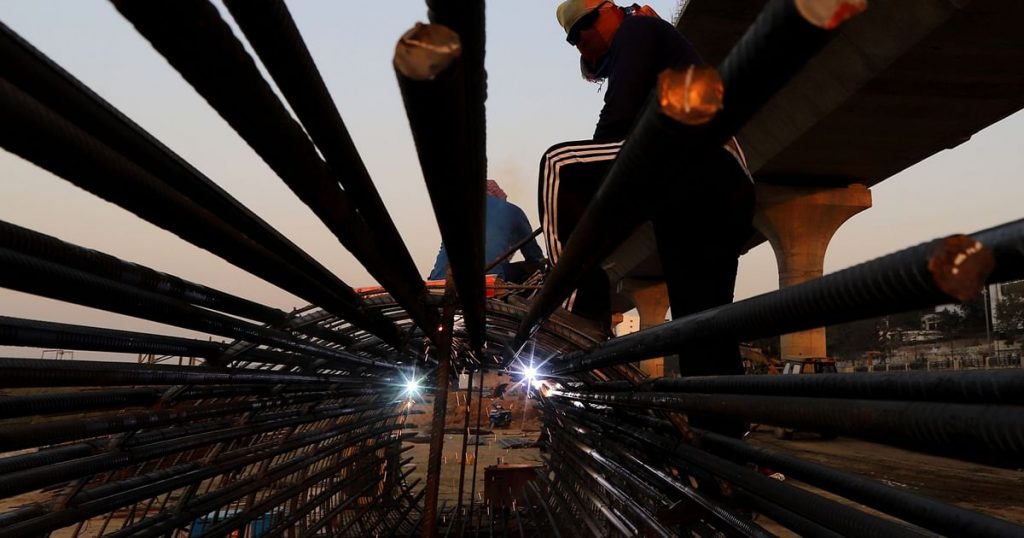

Manufacturing Sector

The organised manufacturing sector saw the quickest rebound as the nationwide and state-level lockdowns reversed.

Sales growth across the sector improved to 7.4% in the third quarter compared to a decline of 4.3% in the previous three months. Growth in Q3 FY21 was also much improved over a contraction of 6.1% a year ago.

As sales improved, raw material and staff costs rebounded.

Raw material costs rose 6.4% in the third quarter after a decline of 9% in the preceding three-month period. Staff costs rebounded, rising 4.6% over a year ago in the third quarter, compared with a decline of 4.8% in Q2.

Interest costs softened, leading to a sharp increase in interest coverage ratio to 6.6 times from 4.6 times in the previous quarter.

Non-IT Services Remained Weak

The non-IT services sector, which includes high contact services such as hotels and trade, remained the weakest in the third quarter.

Sales contracted 5.7% over a year ago for this segment. As a result, salaries remained under pressure and staff costs were down 15.1% over a year ago. Ebitda rose 1.1% over a year earlier.

IT services, which were the least impacted by the Covid-19 crisis, remained steady. Sales rose 5.2% in the three months through December compared with 3.6% in the quarter before. Ebitda growth spiked to 20.9% in the October-December period from 7.2% in the previous three months.