Recently CBDT notified the latest ITR Forms AY 2022-23 / FY 2021-22. What are the changes in the new ITR Forms for AY 2022-23? Which form to use for filing ITR? Let us try to answer these questions in detail.

Let me first share with you the Income Tax Slab rates applicable for AY 2022-23 / FY 2021-22.

As per the Income Tax Act 1961, if the person’s income exceeds the basic limit prescribed by the income tax department in a financial year (currently it is Rs.2,50,000), needs to file an income tax return. Usually, the due dates to file ITR are 31st July for salaried individuals and non-auditable firms. For companies and auditable firms, it is 30th September. However, the IT Department may extend these deadlines.

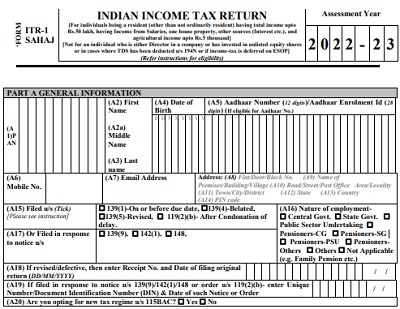

Changes in the ITR Forms for AY 2022-23

Let us now discuss the major changes in the ITR Forms for AY 2022-23.

# Category of Pensioners

In the old ITR forms, for Nature of Employment, an individual receiving pension had to choose the option…