BQ Blue’s special research section collates quality and in-depth equity and economy research reports from across India’s top brokerages, asset managers and research agencies. These reports offer BloombergQuint’s subscribers an opportunity to expand their understanding of companies, sectors and the economy.

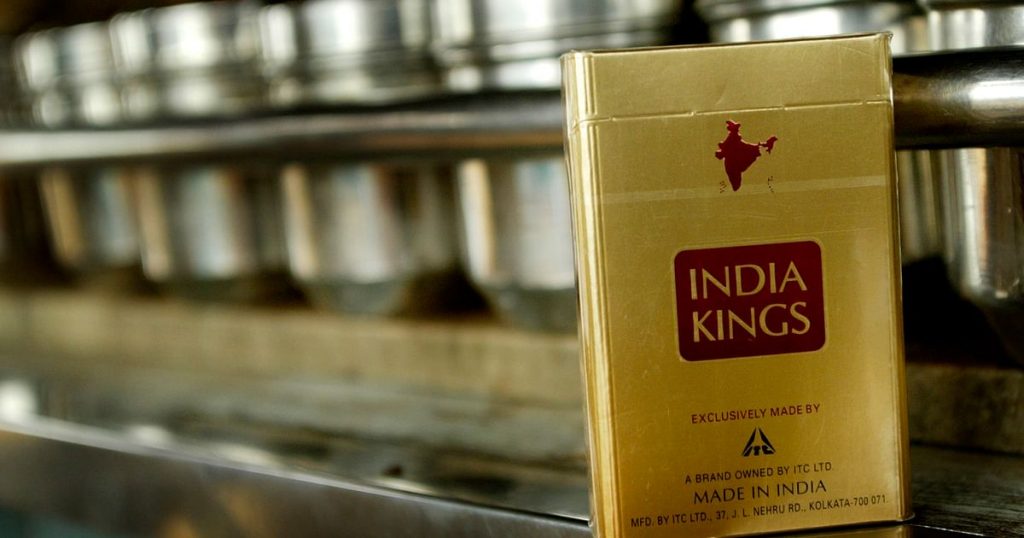

While ITC Ltd. efforts on the overall ESG (environmental, social, and corporate governance) front are truly commendable, the concern over its cigarettes business from an ESG perspective remains at play – as more funds turn ESG-compliant (both globally and in India), affecting the valuations of global cigarette companies, including ITC.

Even if ongoing growth and profitability improvement in ‘Other FMCG’ leads to a 50% Ebit growth compound annual growth rate over FY20–23E, the cigarettes business’ contribution to overall Ebit just barely reduces from 85% in FY20 to 82% in FY23E.

Hence, this does not really move the needle from a cigarettes dependency perspective.

Click on the attachment to read the full report:

DISCLAIMER

This report is authored by an external party. BloombergQuint does not vouch for the accuracy of its contents nor is responsible for them in any way. The contents of this section do not constitute investment advice. For that you must always consult an expert based on your individual needs. The views expressed in the report are that of the brokerage and do not represent the views of BloombergQuint.

Users have no license to copy, modify, or distribute the content without permission of the Original Owner.