In a major change in the finance bill 2023, the govt has brought some changes in mutual fund taxation which will now treat pure debt mutual funds on par with Fixed Deposits. Most of the investors were not very happy with this sudden change, how this change is now a reality and we have to accept it.

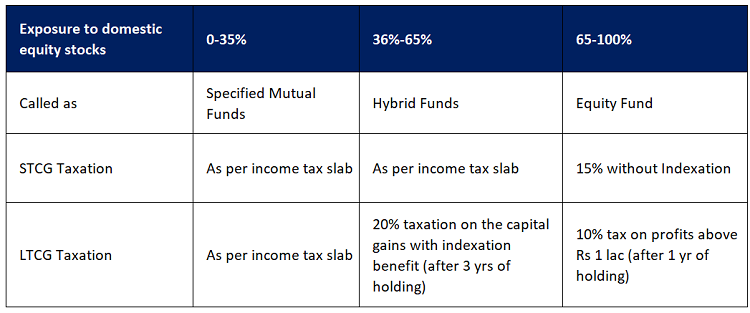

As per the new rule, any mutual fund where not more than 35 per cent of its total proceeds is invested in equity shares of the domestic companies will be termed as “Specified Mutual Fund” and it will be taxed at the marginal rate (as per your slab).

However, the gains from these specified mutual funds will still fall under “short term capital gain” category and not as “interest” income, which still leaves debt funds with some advantages which I will share at the end of this article.

Rule applicable from Apr 1, 2023

This change is applicable only for the new investments which will be made after 1st April, 2023. No impact is there for any old investments.

So if you have any…