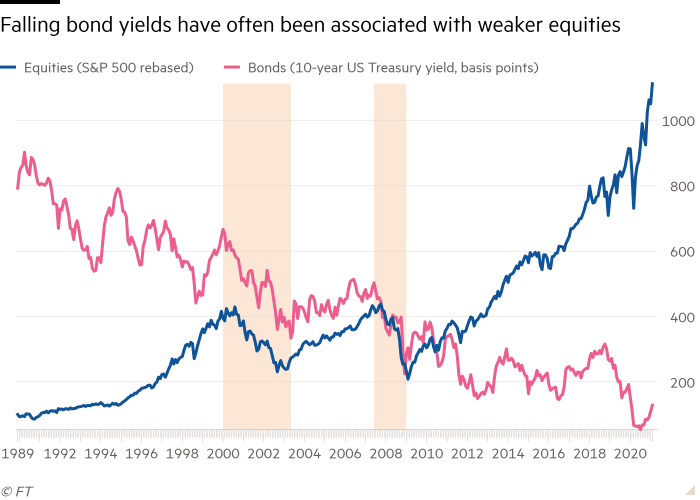

Bond bears are growling louder and that poses a serious question for equity investors. When should they really start worrying about rising 10-year interest rates?

Global economic growth and corporate earnings estimates are picking up, confirming upbeat investor expectations that have propelled equity and commodity prices sharply higher in recent months. Also on the rise are 10-year global interest rates. In the US, Japan, China, Australia, Europe and the UK, they are now at their highest levels in nearly a year.

That is part of the process of validation by financial markets that comes with economic recovery, even when bond yields have been driven down to historically low levels by massive buying programmes of central banks.

“Bond yields moving higher from abnormally low levels suggests rising private sector confidence, and healthier economic and profit growth prospects,” says James Paulsen, chief investment strategist at the Leuthold Group.

Improving recovery…