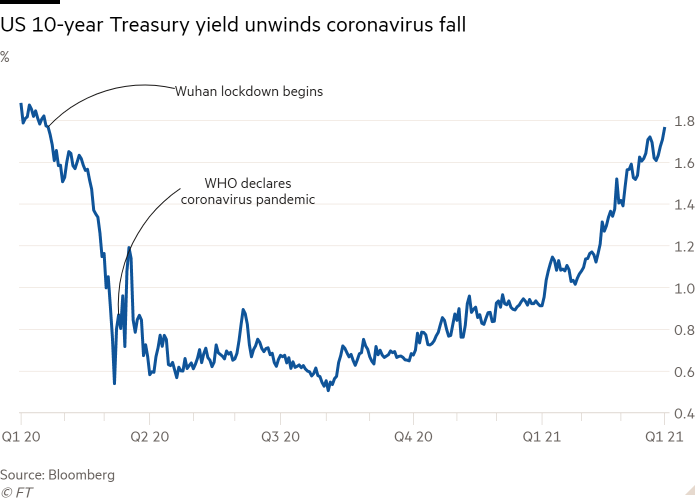

A key measure of US long-term borrowing costs has hit its highest level since the early days of the coronavirus crisis as traders sold Treasuries at the end of a brutal quarter for global government bonds.

The 10-year Treasury yield rose as much as 0.05 percentage points from Monday’s closing level to just above 1.76 per cent, the highest point since January 2020, according to Bloomberg data.

The fresh bout of selling came as investors weighed continued optimism over the US’s vaccine rollout and another plan to boost fiscal stimulus.

US bond markets have led a global retreat in government debt since January as investors fret that the Federal Reserve will allow the economy to run hot, with massive amounts of government spending combining with monetary stimulus to pump up inflation.

A broad Bloomberg Barclays index of debt issued by developed market governments around the world has fallen 5 per cent since the start of the year on a total return basis, snapping…