Small-caps are having a moment.

After years of underperformance, companies with a smaller market capitalisation are rising faster than the bigger, blue-chip names that make up America’s mainstream stock indices.

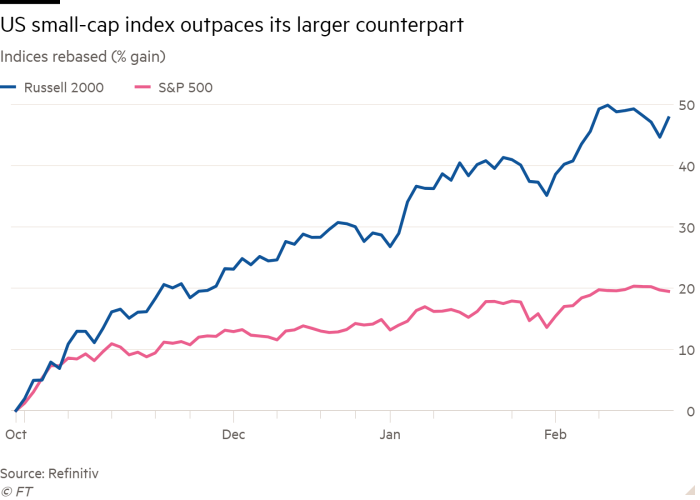

The Russell 2000 index of smaller US-listed companies is up by more than 47 per cent since the start of November, when markets began to shoot higher on vaccine optimism, and has advanced 15 per cent year to date. By comparison, the benchmark S&P 500 is up 19.5 per cent since November and 4 per cent this year.

For months during the pandemic, investors favoured fast-growing tech stocks that were the winners of a shift towards working and shopping online. Smaller companies, whose performance is generally more exposed to traditional consumer trends and more closely tied to economic growth, suffered.

But November’s Covid-19 vaccine breakthroughs prompted investors to shift towards cyclical stocks, lifting the Russell 2000. “Since November, investors have started…