Red-hot spot markets are primarily fueling bitcoin’s recent rally as the leading cryptocurrency trades at three-year highs around $15,500, suggesting the bull market may have room to continue.

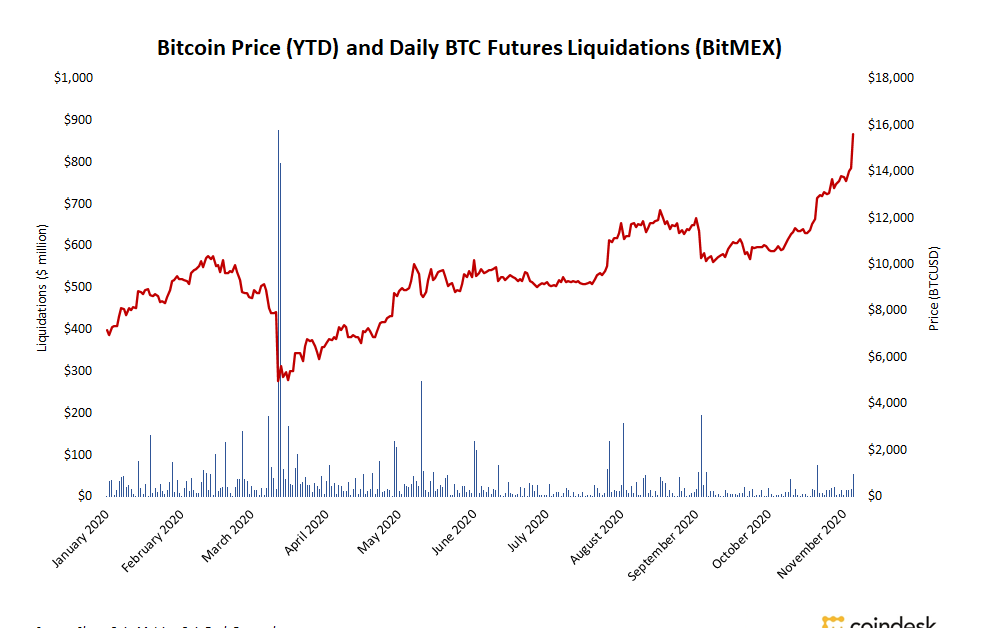

Unlike previously rallies, derivatives markets are playing a markedly less prominent role, demonstrated by mild liquidation volumes.

The presence of derivatives in bitcoin’s ongoing rally is “muted in comparison to previous run-ups,” said Matt Kaye, managing partner at Santa Monica-based Blockhead Capital. Talking to CoinDesk, Kaye said, “The market is clearly spot-dominated, and it appears that most of the bidding is coming out of the U.S.,” continuing a trend CoinDesk reported in May.

On Thursday, BitMEX, a cryptocurrency derivatives exchange known for attracting unorthodox, high-leverage traders, reported $54 million in liquidated bitcoin futures contracts during the most recent…