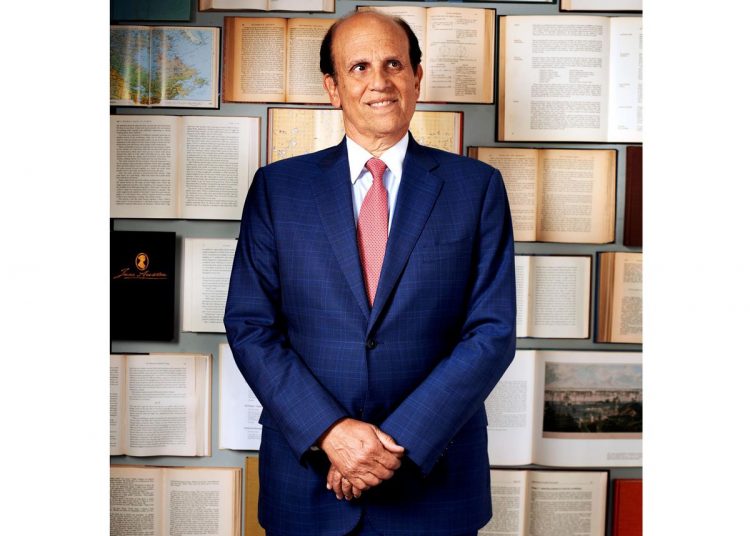

Michael Prince for Forbes

The big money fueling SPAC mania comes from smart hedge funds—dubbed the SPAC mafia— capitalizing on a “no lose” trade. No surprise that a fund backed by brilliant billionaire financier Michael Milken owns nearly 125 SPACs.

If one were to do a case study of the SPAC bubble that overwhelmed U.S. financial markets in 2020 and early 2021, few investments would illustrate the mania better than a vehicle known as Churchill Capital IV.

Listed on the New York Stock Exchange in September 2020 after a $2.1 billion initial public offering, Churchill quickly became one of the hottest SPACs on the market. From January to mid-February 2021, Churchill rose 550% to a $15 billion market capitalization as novice traders on trading apps like Robinhood fervently bid the shell company to the moon in anticipation of its merger with an electric vehicle startup called Lucid Motors. Then, like so many SPACs, after the bubble was pricked by the…